Owner Draw Vs Salary

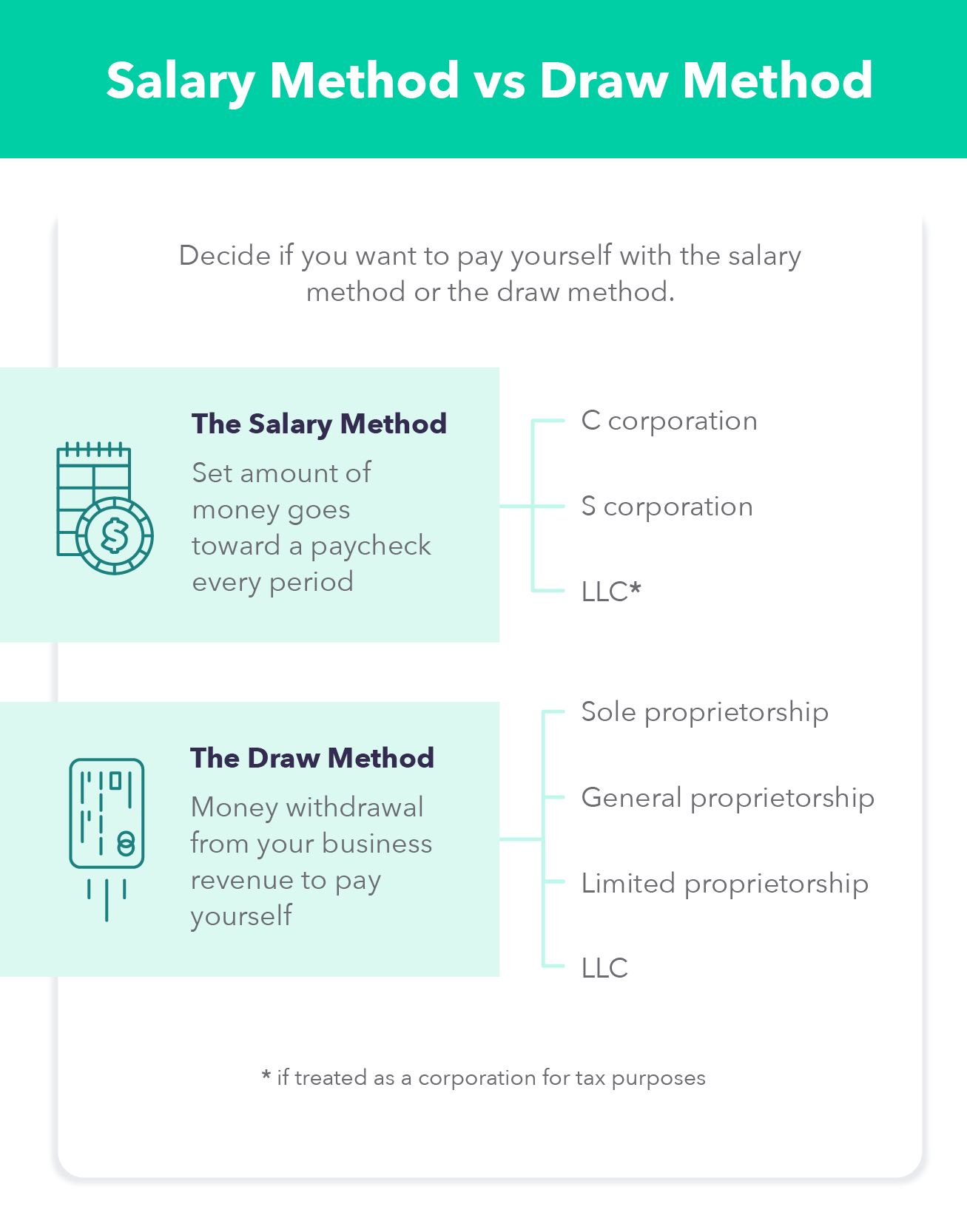

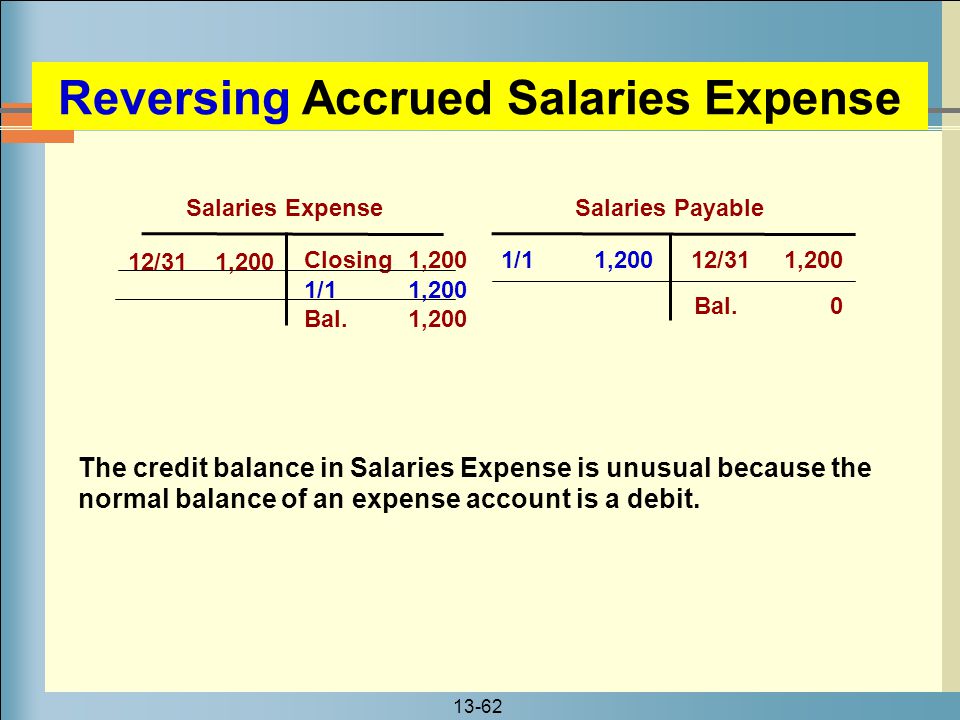

Owner Draw Vs Salary - The difference before we compare the salary method to the draw method, it’s essential to understand the basics of each. Some factors to consider include: Web depending on circumstances and tax implications, there can be benefits to a draw. Paying yourself as a business owner dana sitar the way you set up your business has a ripple effect. Web learn the pros and cons of owner’s draw and salary, two options for paying yourself as a business owner. Web owner’s draw vs. Compare the tax implications, flexibility, and ease of each method based on. However, the type of income you make from your company is highly dependent. Therefore, you can afford to take an owner’s draw for $40,000 this year. Web business owners may choose between different payment methods, such as owner’s draw, salary, dividends, etc. The business owner takes funds out of the business for personal use. As the owner, you can choose to take a. Web business owners may choose between different payment methods, such as owner’s draw, salary, dividends, etc. Web learn the differences between paying yourself with an owner's draw or a salary in an s corp, and how they affect your. Draws can happen at regular intervals, or when needed. Web 26th nov, 2023 if you're the owner of a company, you're probably getting paid somehow. But which method to choose? Web owner’s draw or salary: Web an owner’s draw is when the owner takes funds from the business for personal use. An owner draw may provide a lower tax liability. As the owner, you can choose to take a. The business owner takes funds out of the business for personal use. Some factors to consider include: Web learn the pros and cons of owner’s draw and salary, two options for paying yourself as a business owner. Some factors to consider include: As the owner, you can choose to take a. Before deciding which method is best for you, you must first understand the basics. Web learn the differences between owner’s draw and salary, two common ways to pay yourself as a business owner. Therefore, you can afford to take an owner’s draw for $40,000 this year. But is your current approach the best one? One of the main advantages of being an s. Web another critical difference between an owner's draw and a salary is that a draw is not subject to payroll taxes, such as social security and medicare. However, the type of income you make from your company is highly dependent. Web 26th nov,. One of the main advantages of being an s. Web an owner’s draw is when the owner takes funds from the business for personal use. But is your current approach the best one? Web learn the pros and cons of the draw method and the salary method for small business owners. As the owner, you can choose to take a. Web learn the pros and cons of owner’s draw and salary, two options for paying yourself as a business owner. Owner’s draw:the business owner takes funds out of the business for personal use. Find out the pros and cons of each method, how. As the owner, you can choose to take a. Web owner’s draw vs. Some factors to consider include: Impacting everything from how you manage. However, the type of income you make from your company is highly dependent. Find out how to determine reasonable compensation, how. Before deciding which method is best for you, you must first understand the basics. One of the main advantages of being an s. Compare the tax implications, flexibility, and ease of each method based on. Web learn the pros and cons of the draw method and the salary method for small business owners. Therefore, you can afford to take an owner’s draw for $40,000 this year. Web business owners may choose between different payment. An owner draw may provide a lower tax liability. Web business owners may choose between different payment methods, such as owner’s draw, salary, dividends, etc. Pulling these funds can be on a regular schedule or just when needed, and. Owner’s draw:the business owner takes funds out of the business for personal use. Find out how to determine reasonable compensation, how. This payment is made to each member as their. Web owner’s draw or salary: But is your current approach the best one? The business owner takes funds out of the business for personal use. Pulling these funds can be on a regular schedule or just when needed, and. Web your own equity in the business is at $60,000. Web an owner’s draw is when the owner takes funds from the business for personal use. Owner’s draw:the business owner takes funds out of the business for personal use. Understand the difference between salary vs. Some factors to consider include: Web owner’s draw vs. The difference before we compare the salary method to the draw method, it’s essential to understand the basics of each. Find out the pros and cons of each method, how. However, the type of income you make from your company is highly dependent. Web learn the differences between an owner's draw and a salary, the pros and cons of each, and how to pay yourself from your business account. Impacting everything from how you manage.

How Should I Pay Myself? Owner's Draw Vs Salary Business Law

Owner’s Draw vs. Salary How to Pay Yourself Bench Accounting

How to Pay Yourself ? Owner’s Draw vs. Salary. Aenten US

Owner's Draw Vs Salary DRAWING IDEAS

Owner's Draw vs. Salary

Owner's draw vs payroll salary paying yourself as an owner with Hector

Entrepreneur Salary 5 Steps to Paying Yourself First MintLife Blog

Small Business Owners Salary vs Draw YouTube

Pay Yourself Salary or Draw for Business Owners & LLCs Next Level

Salary for Small Business Owners How to Pay Yourself & Which Method

An Owner Draw May Provide A Lower Tax Liability.

Therefore, You Can Afford To Take An Owner’s Draw For $40,000 This Year.

As The Owner, You Can Choose To Take A.

Draws Can Happen At Regular Intervals, Or When Needed.

Related Post: