Non Profit Donation Receipt Template

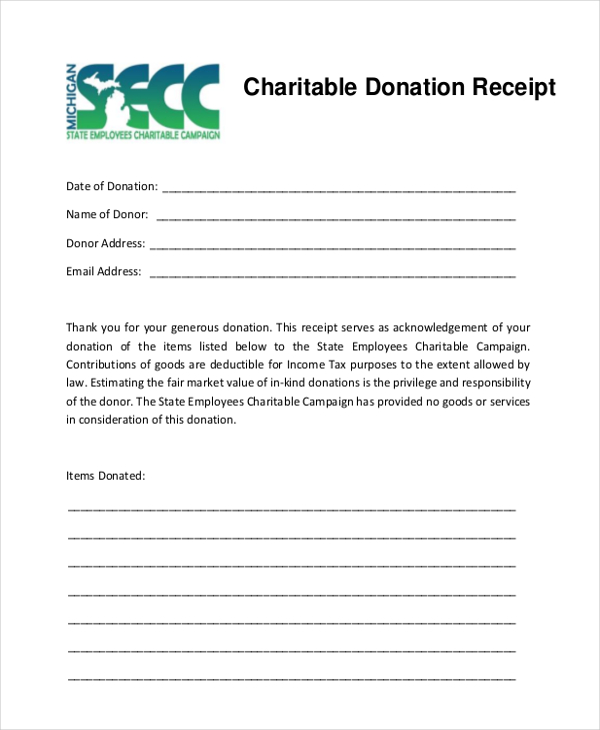

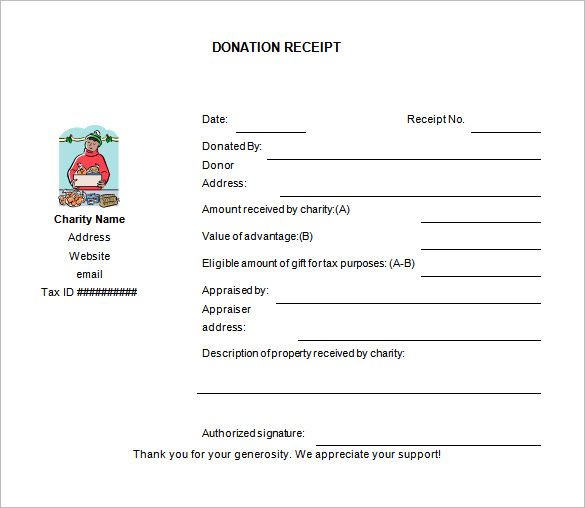

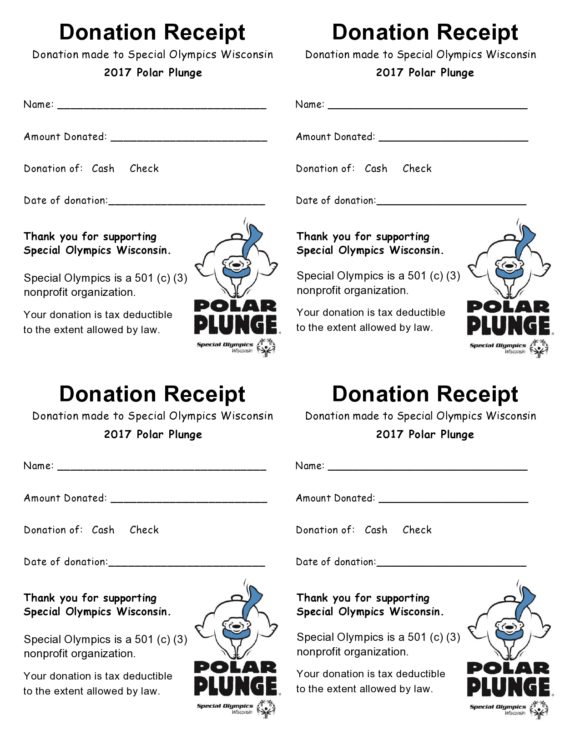

Non Profit Donation Receipt Template - It helps taxpayers determine potential tax deductions on their annual filings. When is a nonprofit donation receipt required? A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. You also have the ability to attach a pdf of the donation receipt in donor receipt emails. Web here are some best practices to follow when creating a donation receipt template: Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Donors use them as a confirmation that their gift was received; They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. Web donation receipt templates let’s get started! Scroll down to “enhance your campaign” and click “receipt emails.”. They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. Web free nonprofit donation receipt templates for every giving scenario. Use our easy template editor. The organization should also fill in their details and. Nonprofit donation receipts make donors happy and are useful for your nonprofit. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. It allows you to create and customize the draft of your receipt contents. Made to meet canada and the usa requirements. The charity organization that receives the donation should provide a receipt with their details included.. You also have the ability to attach a pdf of the donation receipt in donor receipt emails. Web donation receipt templates let’s get started! The charity organization that receives the donation should provide a receipt with their details included. Use our easy template editor. Web these email and letter templates will help you create compelling donation receipts without taking your. You also have the ability to attach a pdf of the donation receipt in donor receipt emails. The charity organization that receives the donation should provide a receipt with their details included. Why do you need a donation receipt? Nonprofit donation receipts make donors happy and are useful for your nonprofit. Use our easy template editor. Donors use them as a confirmation that their gift was received; Why do you need a donation receipt? They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web these. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: The organization should also fill in their details and. You also have the ability to attach a pdf of the donation receipt in donor receipt emails. Web donation receipt templates let’s get started! A 501 (c) (3) donation receipt. Web here are some best practices to follow when creating a donation receipt template: Web check out this solution for more info. It allows you to create and customize the draft of your receipt contents. The organization should also fill in their details and. Under the irs itemized deduction section, the donors can have their cash or property donations reimbursed,. Web free nonprofit donation receipt templates for every giving scenario. When is a nonprofit donation receipt required? Web check out this solution for more info. They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. Web here are some best practices to follow when creating a donation receipt template: Nonprofit donation receipts make donors happy and are useful for your nonprofit. Web free nonprofit donation receipt templates for every giving scenario. The charity organization that receives the donation should provide a receipt with their details included. When is a nonprofit donation receipt required? It helps taxpayers determine potential tax deductions on their annual filings. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Nonprofit donation receipts make donors happy and are useful for your nonprofit. The charity organization that receives the donation should provide a receipt with their details included. Use our easy template editor. Web donation receipt templates let’s get started! They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. Web donation receipt templates let’s get started! Why do you need a donation receipt? Web here are some best practices to follow when creating a donation receipt template: You also have the ability to attach a pdf of the donation receipt in donor receipt emails. Nonprofit donation receipts make donors happy and are useful for your nonprofit. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. The organization should also fill in their details and. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Donors use them as a confirmation that their gift was received; Scroll down to “enhance your campaign” and click “receipt emails.”. Made to meet canada and the usa requirements. It helps taxpayers determine potential tax deductions on their annual filings. Use our easy template editor. It allows you to create and customize the draft of your receipt contents. Web free nonprofit donation receipt templates for every giving scenario.

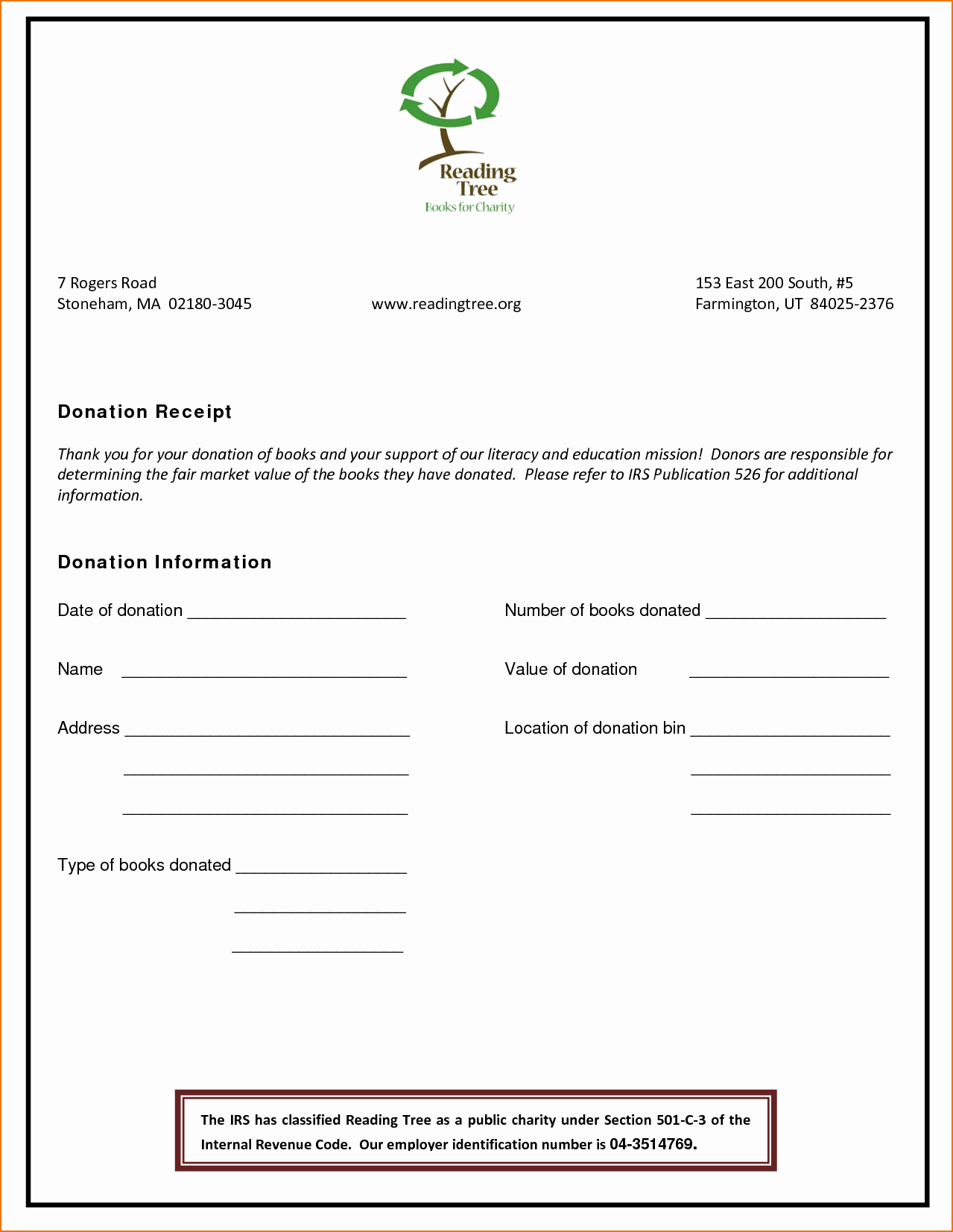

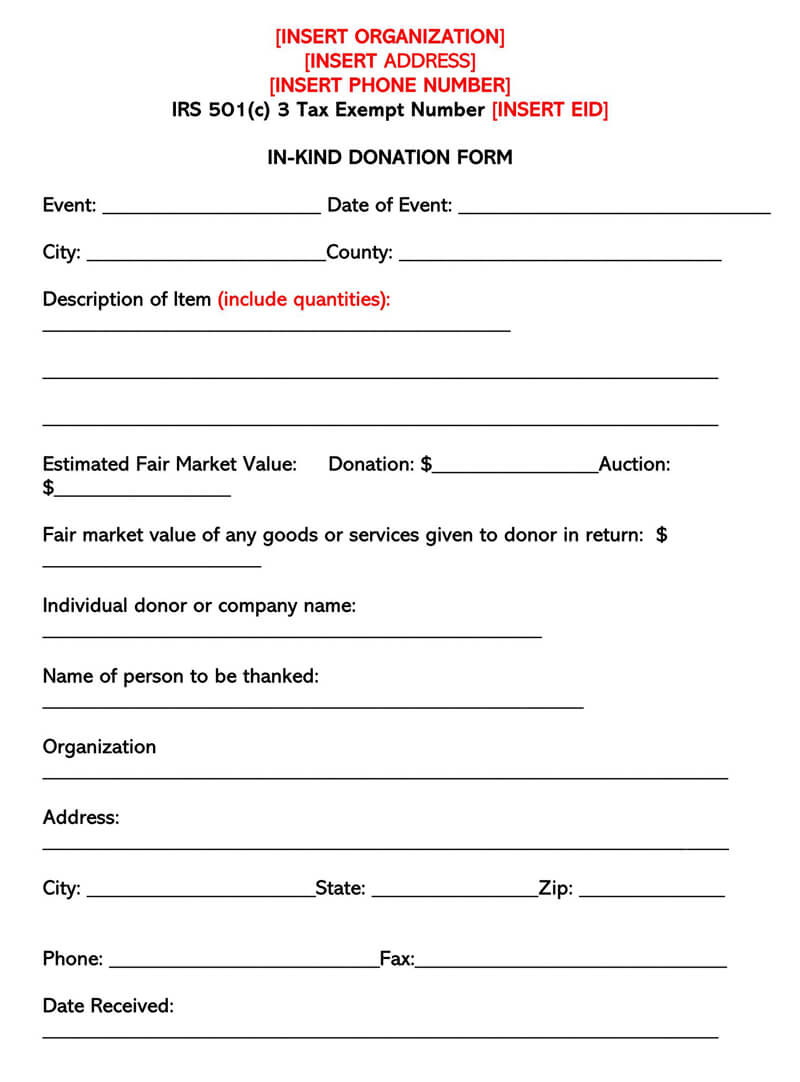

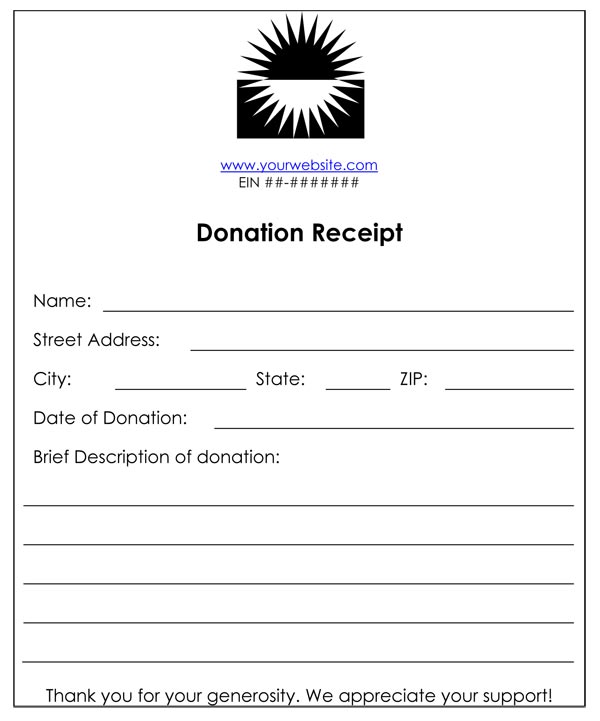

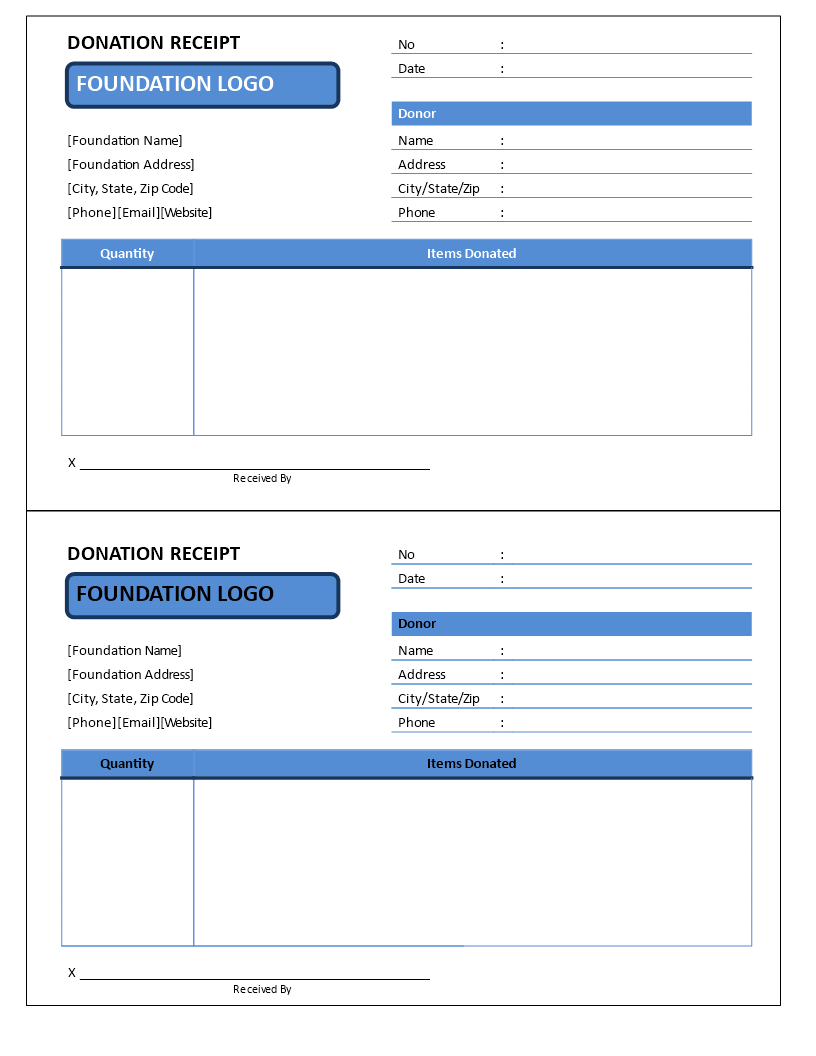

Non Profit Donation Receipt Template Excel Templates

Free Nonprofit (Donation) Receipt Templates (Forms)

Non Profit Receipt Template printable receipt template

Non profit donation receipt template Templates at

Free Printable Donation Receipt Template Printable Templates

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-40.jpg)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

FREE 8+ Sample Donation Receipt Forms in PDF Excel

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-27.jpg)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Nonprofit Receipt 5+ Examples, Format, Pdf Examples

30 Non Profit Donation Receipt Templates (PDF, Word) PrintableTemplates

Web Check Out This Solution For More Info.

Try To Avoid Technical Terms Or Jargon That May Confuse Donors.

When Is A Nonprofit Donation Receipt Required?

Under The Irs Itemized Deduction Section, The Donors Can Have Their Cash Or Property Donations Reimbursed, Specifically Those That Are Above 250 Dollars And Are Made To.

Related Post: