Indication Of Interest Template

Indication Of Interest Template - Web learn what an indication of interest (ioi) is, why it is important in the m&a process, and how to create a compelling and effective ioi. Web the indication of interest (also known as the indication or ioi) is a key landmark in any m&a deal. This document provided by the buyer suggests a valuation range that he is willing to pay for a company. Typically, a seller receives indications from numerous buyers. Meetings, letters of intent, due diligence, and (cross your fingers) the closing. Follow the key points to include the approximate price. Web learn how to write an indication of interest (ioi) for an m&a deal, a document that shows the buyer's genuine interest in purchasing the business. Web the indication and its key piece of information, the valuation range, merely set up the next steps for the m&a process: The investor's broker must provide the investor with a preliminary. Purchase price and form of consideration. Follow the key points to include the approximate price. Web an indication of interest (ioi) is a formal letter or document expressing interest in purchasing a company or its securities. Purchase price and form of consideration. The loi includes the transaction overview, timeline, due diligence, confidentiality, exclusivity and letters of intent. But those aren’t the only aspects of the indication. Purchase price and form of consideration. Download the free template and see an example of an loi. The investor's broker must provide the investor with a preliminary. Download a free template for an loi. Sending out a generic “dear hr director” or “to whom it may concern” isn’t going to win you any brownie points. Sending your letter of interest out with a generic heading. The ioi will also include commentary on potential synergies from the buyer’s perspective, timing and ideas around structuring that give an indication to. Web learn what an indication of interest (ioi) is, why it is important in the m&a process, and how to create a compelling and effective ioi. Web. Web an indication of interest (ioi) is a formal letter or document expressing interest in purchasing a company or its securities. Purchase price and form of consideration. Download a free template to streamline your m&a deals and set you up for success. In the event that the purchaser submits an indication of interest for less than 9.9% of the units. Find out the major characteristics, contents, and process of an loi, as well as how to avoid common mistakes and pitfalls. Web learn how to write a letter of intent (loi) for an m&a transaction, a document that can affect the price, terms, and conditions of the deal. Web an indication of interest (ioi) is a formal letter or document. Web learn what an indication of interest letter is, how to write one, and what elements to include. Web the indication and its key piece of information, the valuation range, merely set up the next steps for the m&a process: See a fictional example of a sample ioi for a business acquisition. Web learn how to write an indication of. The eoi starts with some introductory praise directed towards the seller’s company. Web learn how to write an indication of interest (ioi) for an m&a deal, a document that shows the buyer's genuine interest in purchasing the business. Find out the eligibility criteria, the process, and the risks associated with investing in a public offering. Web learn what an indication. Web learn what an indication of interest (ioi) is, why it is important in the m&a process, and how to create a compelling and effective ioi. Purchase price and form of consideration. Sending your letter of interest out with a generic heading. Follow the key points to include the approximate price. Find out the eligibility criteria, the process, and the. The ioi will also include commentary on potential synergies from the buyer’s perspective, timing and ideas around structuring that give an indication to. Web [full vc fund name] indication of interest the undersigned indicates an interest in making an investment in [full vc fund name] (the “ fund ”) on the terms set forth in the summary of terms attached. Sending your letter of interest out with a generic heading. Web learn how to write an indication of interest (ioi) for an m&a deal, a document that shows the buyer's genuine interest in purchasing the business. Typically, a seller receives indications from numerous buyers. Materials you’ll need to sell your company 16 the indication of interest (ioi) 20 the letter. Web the eoi indicates a serious interest from the buyer that their company would be interested to pay a certain valuation and acquire the seller’s company through a formal offer. Find out the major characteristics, contents, and process of an loi, as well as how to avoid common mistakes and pitfalls. But those aren’t the only aspects of the indication. Web learn what an indication of interest (ioi) is, why it is important in the m&a process, and how to create a compelling and effective ioi. The investor's broker must provide the investor with a preliminary. Web the indication and its key piece of information, the valuation range, merely set up the next steps for the m&a process: See a fictional example of a sample ioi for a business acquisition. Web pursuant to our discussions, we submit this indication of interest (“ioi”) which outlines our intentions with respect to the contemplated transaction. Web learn how to write an indication of interest (ioi) for an m&a deal, a document that shows the buyer's genuine interest in purchasing the business. Web learn how to write a letter of intent (loi) for an m&a transaction, a document that can affect the price, terms, and conditions of the deal. Sending your letter of interest out with a generic heading. Web an indication of interest (ioi) is a formal letter or document expressing interest in purchasing a company or its securities. Download a free template for an loi. Follow the key points to include the approximate price. Find out the key components, tips, and common mistakes to avoid when crafting an ioi. Download the free template and see an example of an loi.

Letter of Intent Acquisition of Business Download in Word, Google

FREE 9+ Sample Letter of Intent to Purchase Business in PDF MS Word

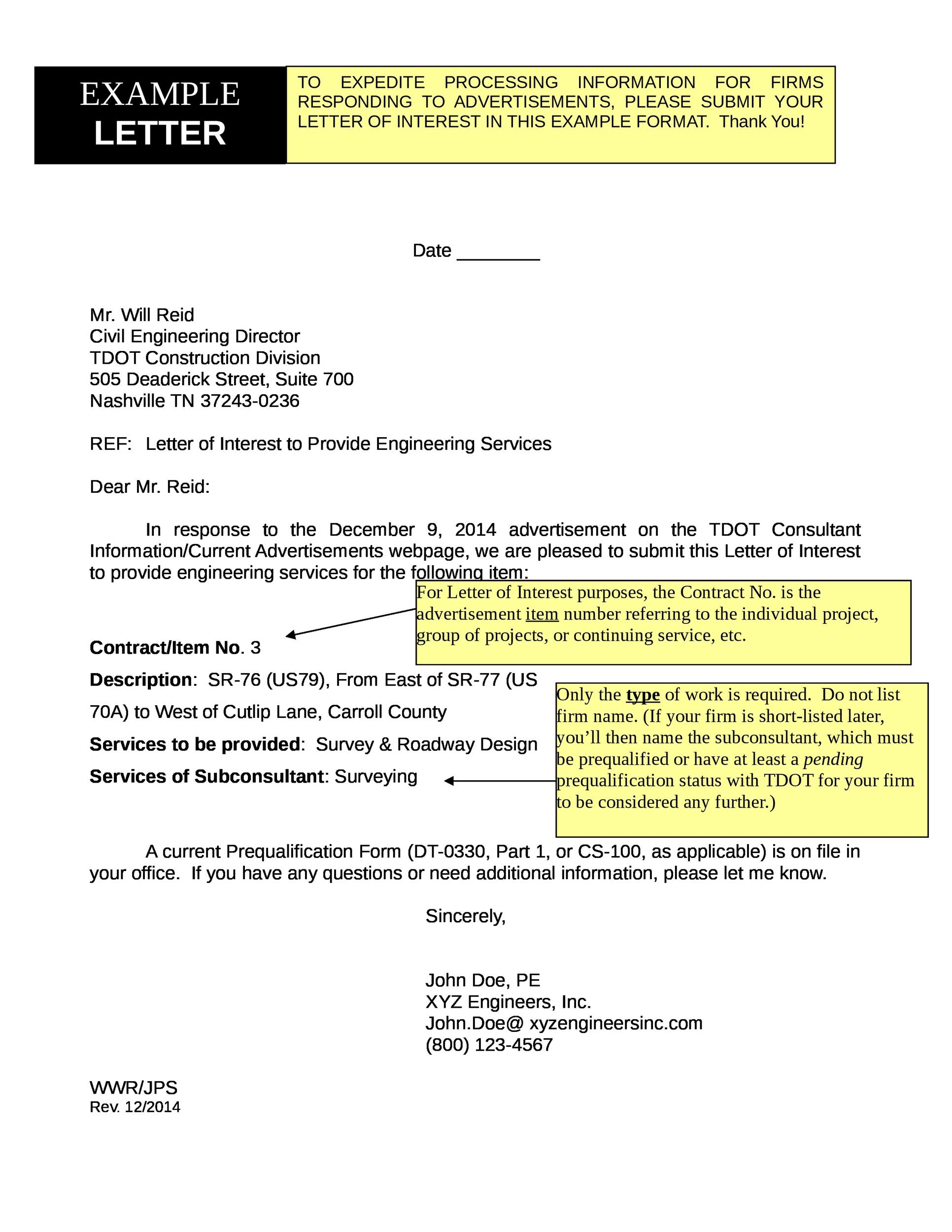

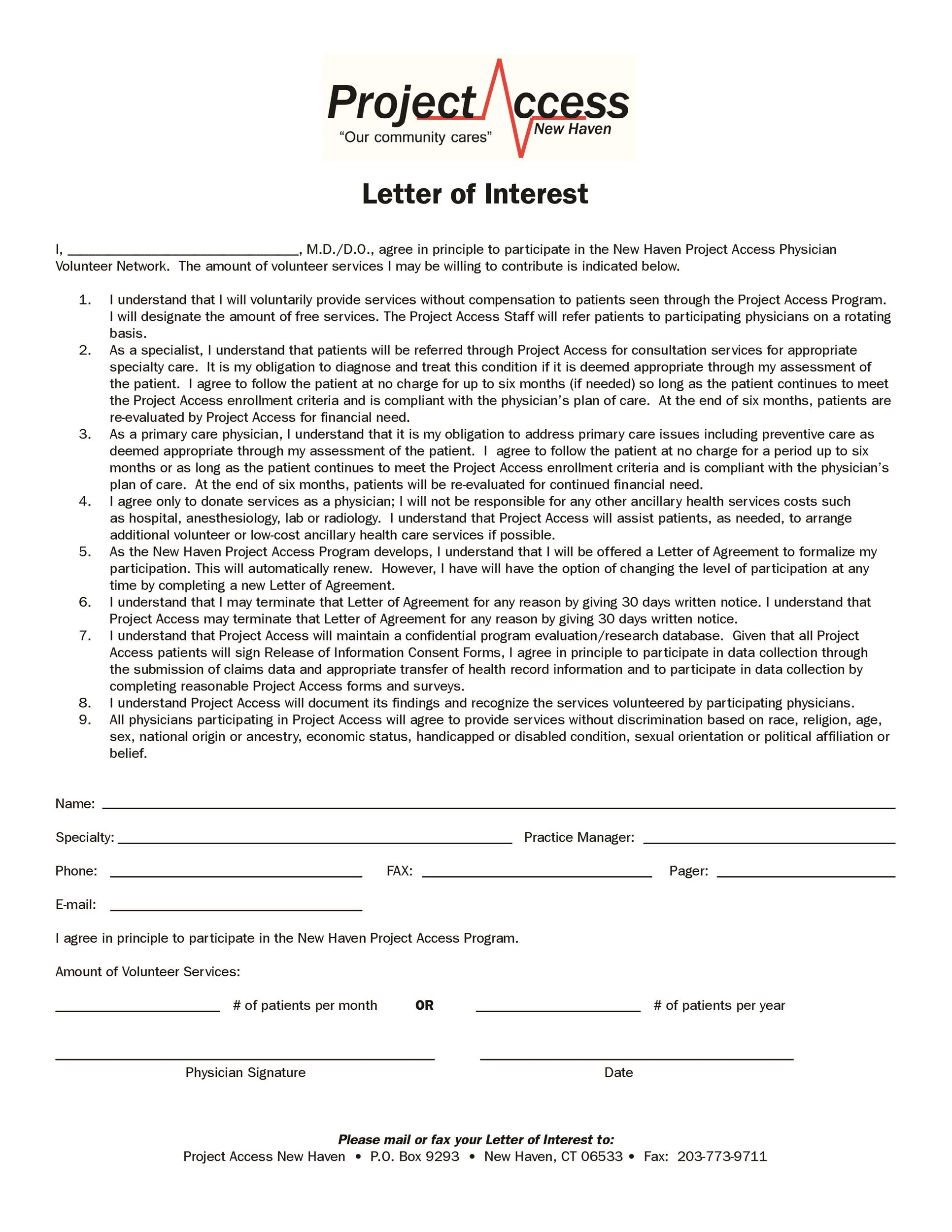

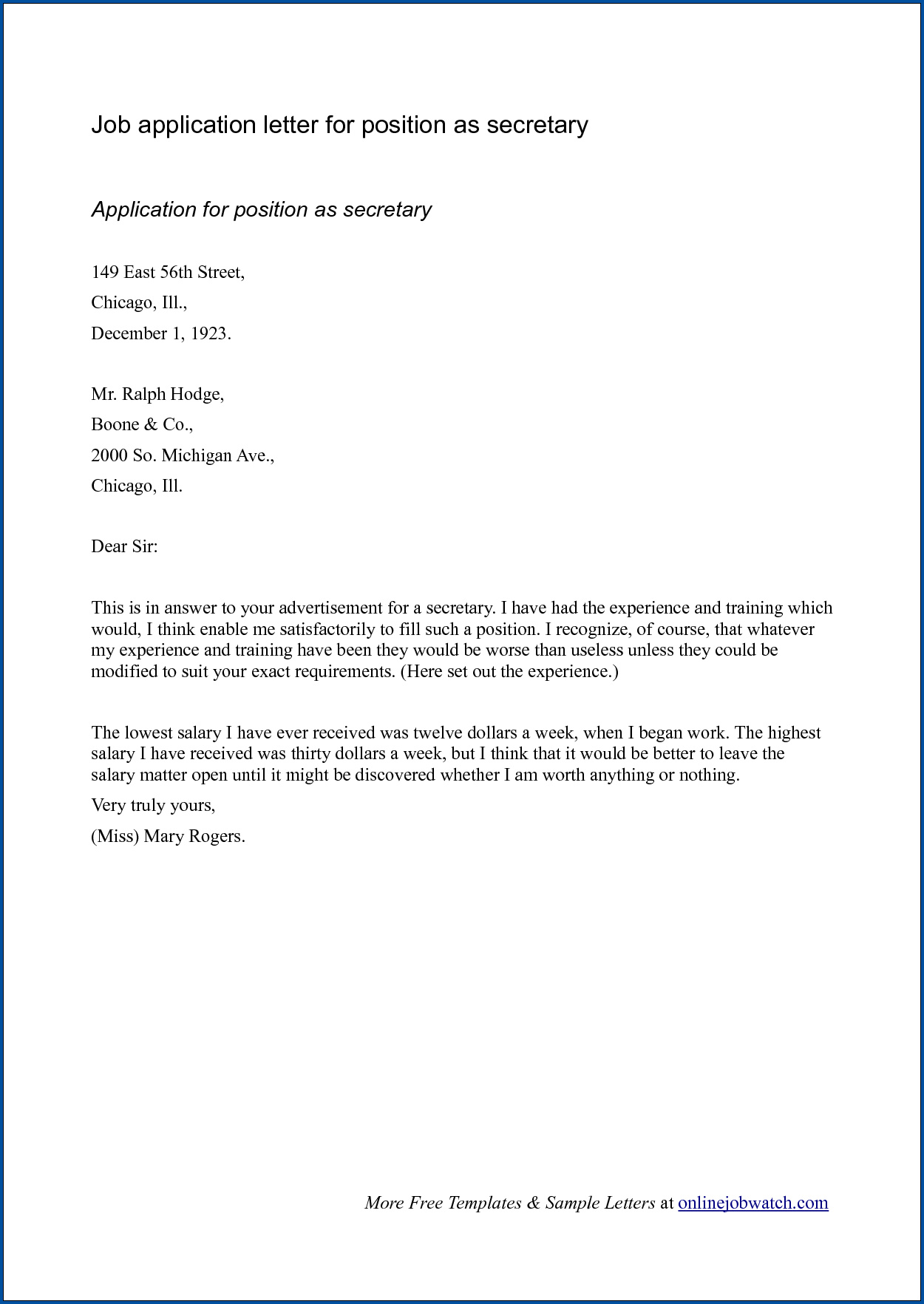

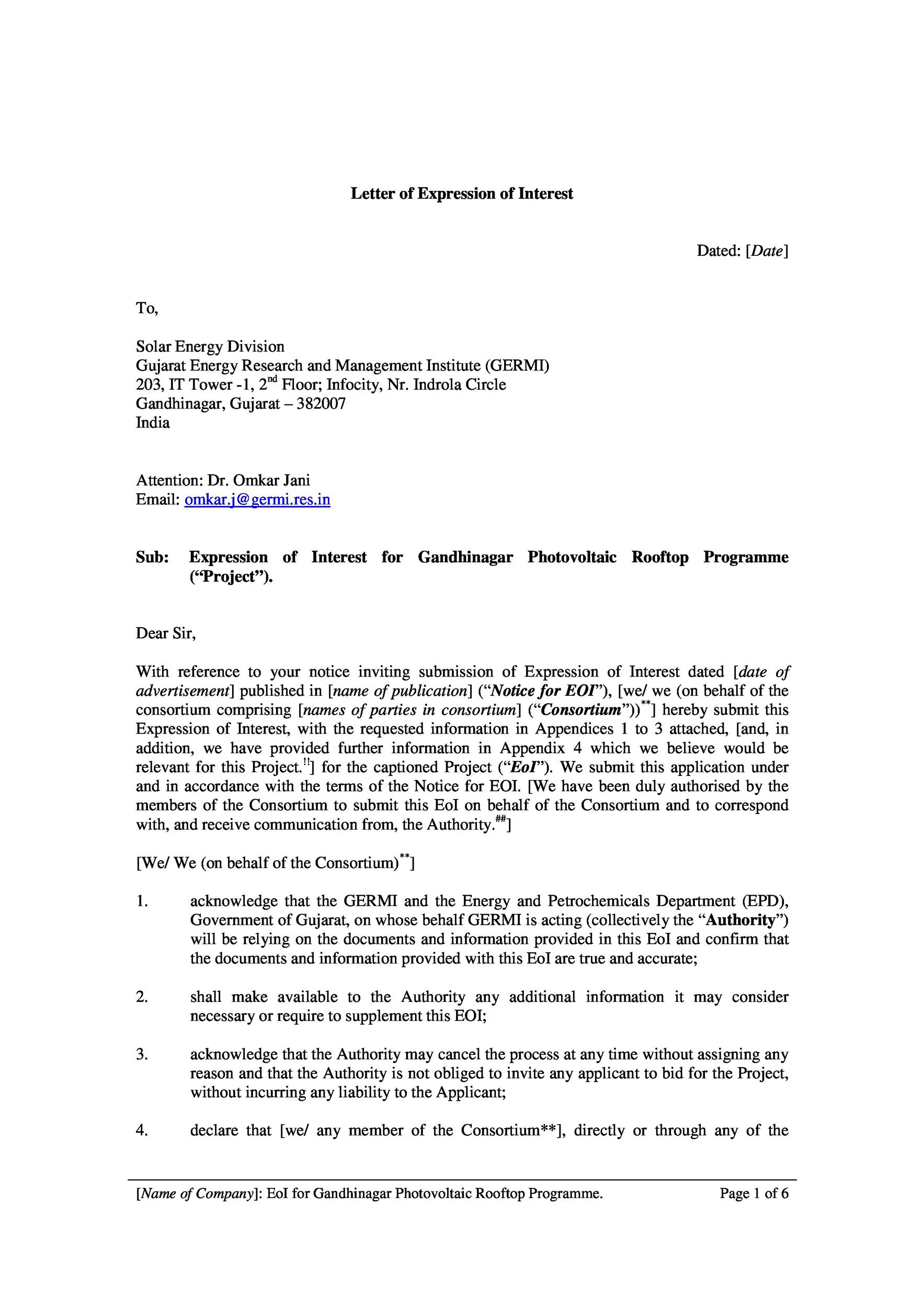

30+ Amazing Letter of Interest Samples & Templates

30+ Amazing Letter of Interest Samples & Templates

Letter Of Interest Template Free Download Printable Templates Free

30+ Amazing Letter of Interest Samples & Templates

Free Business Proposal Letter of Intent Template PDF Word

Letter Of Intent To Sell A Business Template Resume Letter

√ Free Printable Letter Of Interest For A Job

30+ Amazing Letter of Interest Samples & Templates

Learn The Difference Between Indications Of Interest For Securities And Investments And Mergers And Acquisitions, And See How To Write An Ioi For Each Purpose.

Sending Out A Generic “Dear Hr Director” Or “To Whom It May Concern” Isn’t Going To Win You Any Brownie Points.

Meetings, Letters Of Intent, Due Diligence, And (Cross Your Fingers) The Closing.

In The Event That The Purchaser Submits An Indication Of Interest For Less Than 9.9% Of The Units To Be Sold In The Ipo, Does Not Submit Any Indication Of Interest In The Ipo O.

Related Post: